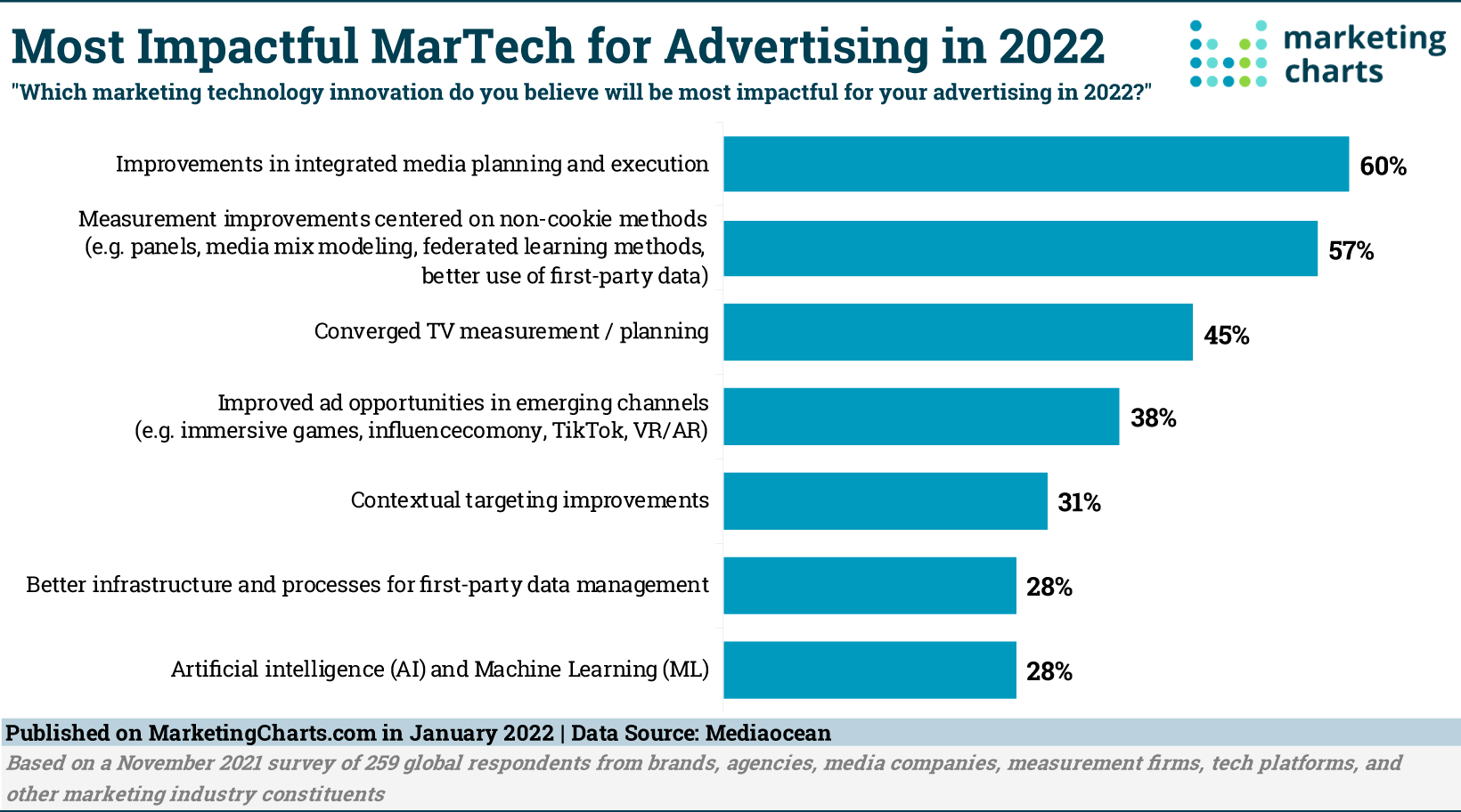

Last year, media professionals cited third-party cookie deprecation as their top challenge, with the collection of first-party data becoming more important to accommodate for the loss of third-party data. Given this information, it should come as no surprise that close to 6 in 10 (57% of) global advertisers believe that measurement improvements centered on non-cookie methods will be one of the most impactive marketing technology innovations this year, per a report [download page] from Mediaocean.

As well as these measurement improvements — which include panels, media mix modeling, federated learning methods and better use of first-party data — a full 60% of respondents believe that improvements in integrated media planning and execution will be impactful for their advertising in 2022. Others cite marketing innovations such as converged TV measurement and planning (45%) and improved ad opportunities in emerging channels such as immersive games, “influenceconomy”, TikTok and VR/AR (38%).

These marketing technology innovations will hopefully alleviate some of the largest areas of concern for respondents – such as the decline in the ability to measure campaign effectiveness on tech platforms and the open web, lack of preparedness for a cookieless future, and loss of access to third-party data.

Another area of concern cited by more than two-fifths (44%) of respondents is the poor ability to manage reach across connected TV (CTV) and digital channels. This is an important concern considering that 7 in 10 respondents believe their ad spending on CTV this year will grow either incrementally (between 1-20%; 51%) or significantly (between 21-50%; 18%).

In regards to CTV advertising, despite video ad viewability being very high for CTV, respondents are concerned about viewability and ad fraud on CTV. More generally, the majority (57%) of respondents expect their concerns around brand safety and the suitability of ad placement to remain the same this year.

The full report can be found here.

About the Data: Findings are based on a November 2021 survey of 259 global respondents representing brands, agencies, media companies, measurement firms, tech platforms and other marketing industry constituents.